Litigation Settlements

The timeshare industry thrives on delays and false promises trying to wear down opponents, but your Law Firm just keeps rapidly and unwaveringly heading in one direction (Trial), unless the resort satisfies the Settlement Mandates under this Agreement. And, these mandates shall be openly shared with the Defendant Resort.

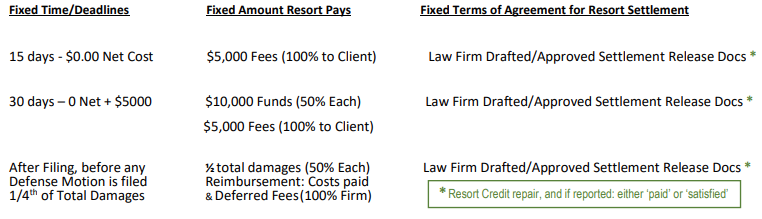

Settlement Mandates are as follows:

Litigation Costs and Attorney Fees

All litigation costs and all attorney fees from the date of representation (payment of the retainer on a fully signed Attorney-Client Representation and Litigation Agreement), until the date of a final adjudicated judgment or final settlement, shall be paid and/or covered under the Retainer. All attorney fees are ultimately anticipated to be paid by the Defendant. Accordingly, the Retainer is the one, and total, expenditure for our clients.

If they not offered to say “yes” to any form of early settlement – the that is the resort really saying that you have to sue them to get out. Then the $5,000 you paid will seem like the best deal you ever made because it could have cost tens of thousands to hundreds of thousands of dollars (the Firm can strategically evolve to a multi-party action, or even seek certification as a Class Action in order to defend your rights). And no matter the costs, you only pay a mere fraction of the potential total cost and the law firm subsidizes any additional costs. That is huge empowerment for a consumer victim of timeshare fraud. You will possess measurable leverage and the litigation would cost the resort Millions ultimately in bad press, and such a result makes you Larger-than-Life in front of a multibillion-dollar resort.